July, investment huge black stone Acquired the assets of the Hipgnosis Songs Fund from HSF’s then-public shareholders in a deal valued at $1.584 billion.

according to MBW’s The analysis shows that when HSF’s debt is taken into account, the deal gives HSF’s 45,000-song portfolio an enterprise value of approx. $2.2 billion.

The same portfolio (originally accumulated by the former Hipgnosis boss between 2018 and 2021) Merck) has just been revalued, courtesy of a new report Kroll Bond Rating Agency.

Guess what? This not only shows that the songs obtained mercury exist HSF Significant growth in value – this also shows black stone It was a bit cheap when I bought it.

Kroll’s The report cited an unnamed independent third-party valuation firm that valued HSF’s portfolio at US$2.36 billion Effective August 1, 2024.

just around here US$150 million Over the total amount HSF has purchased its portfolio over the years (US$2.206 billionaccording to financial documents).

Also around US$150 million Exceeds the estimated enterprise value of the portfolio $2.2 billion when black stone Got it this summer.

Kroll’s Newly announced valuation HSF Assets appear in a report confirming 45,000 songs Content contained in the “traditional” HSF directory is used as collateral Asset-backed securities (ABS) Transaction (i.e. bond issuance).

The ABS transaction, referred to as Lyra Music Assets (Delaware) LPwill see Blackstone raise funds US$1.474 billion in debt financing.

Kroll said the new valuation of HSF’s assets was carried out using a discount rate 8.25% and discounted cash flow methods based on cash flow forecasts.

this Kroll The report pointed out that US$2.36 billion The valuation does not give any recognition of income generated from name, likeness and likeness rights.

“The valuation agent’s valuation of the catalog is $2.36 billion… [its] This approach is current industry practice for valuing comparable assets.

Kroll report on Hipgnosis Songs fund assets (now owned by Blackstone)

Explaining the unnamed appraiser’s approach, Kroll Wrote: “The valuation agent valued the catalog at US$2.36 billion…the valuation agent uses an income approach and assumes the discounted net present value of expected long-term free cash flows 8.50% for directories.

“This approach is current industry practice for valuing comparable assets. The valuation agency conducts a long-term forecast of the catalog for approximately 40 years and then uses terminal growth and decay rates to estimate the duration of the forecast period based on certain assumptions regarding projected financial performance. external cash flow.

Kroll added, “Valuation agents apply a variety of long-term growth and decay rates to each asset in the catalog, reflecting their view of the industry and each songwriter’s performance. The average growth rate for valuations is determined to be approximately 2.00%“.

The valuation was published on Kroll’s The report beats recent valuations for HSF assets by hundreds of millions of dollars shooting tower capital, The point of which is $1.95 billion (Based on HSF’s performance as of end-September 2023).

Shot Tower’s valuation is based on discount rate 9.25%. (Essentially, applying a higher discount rate results in a lower valuation, and vice versa.)

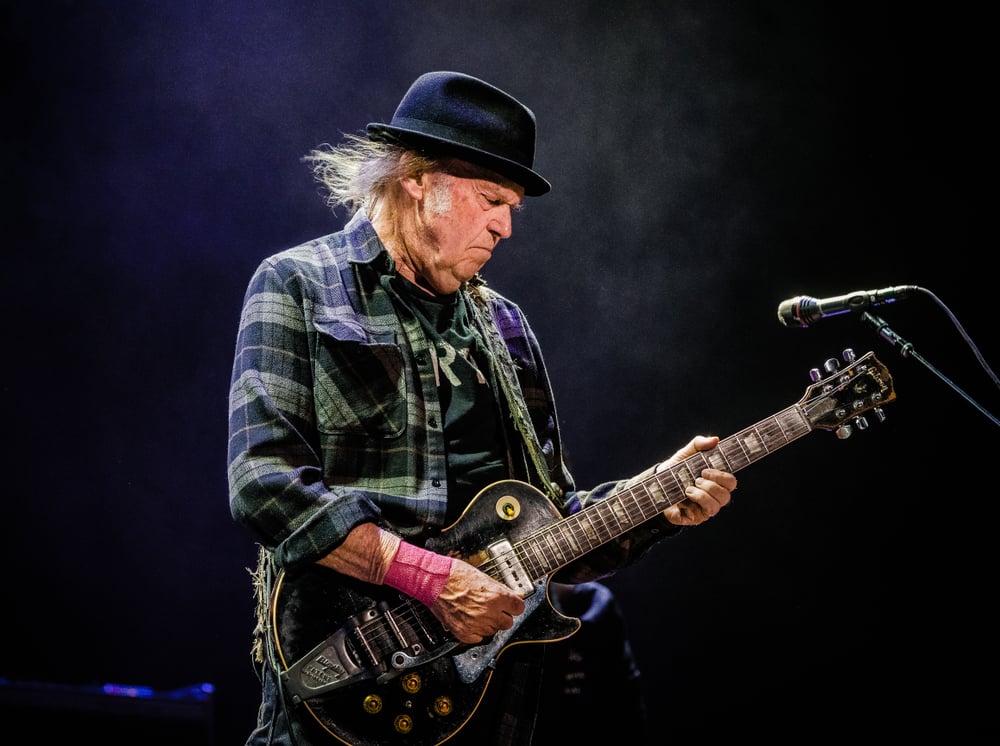

Lyra music assets This is Hipgnosis Songs Assets’ second music royalty securitization and will be collateralized by royalties from what it calls its “legacy song portfolio,” which includes content from artists and songwriters including Red Hot Chili Peppers, Neil Young, Journey, The Chainsmokers and Shakira.

according to Kroll’s Proceeds from the transaction will be used to fund “reserve accounts, pay certain transaction expenses, repay existing debt and other general corporate purposes,” the report said.

Back in 2022, previous pre-sale reports came from Kroll Hipgnosis confirmed to be launching music royalty-backed bond scheme – $221.65 million Securitization issuance.

KBRA confirmed at the time that the offering was called Music 2022-1“will be collateralized by royalties from a music catalog containing more than 950 songs across five subcategories from top artists and songwriters, including Justin Timberlake, Nelly Furtado Nelly Furtado and Leonard Cohen.”

Copyright-backed securitization is becoming an increasingly common way for music companies to raise capital.

Just two weeks ago, a report from the Kroll Bond Rating Agency also revealed that harmony recently proposed US$850 million Debt financing through private securitization backed by its catalog of music rights.

The same report also revealed $217.3 million Was used to obtain the catalog of a mysterious Latin music superstar, Daddy Yankee.

Concordant US$850 million ABS transactions, which Kroll calls issuance Series 2024-1 Notes, Marks writings as part of wider release of third series of notes $2.6 billion Bond release backed by music rights in Concord’s catalog.

Elsewhere in the music industry, in March, Kobalt confirmed that $266.5 million Through its first-ever asset-backed securitization (ABS) transaction, the deal is backed by music royalties from more than 5,000 works by 66 authors.

Also in March, HarborView Equity Partners secured approx. US$500 million Debt financing through private securitization backed by its catalog of music royalties.

In 2022, SESAC Music Group also reportedly closed $335 million Bond trading.

Bonds act a bit like loans, but a group of investors provide funds to a company rather than the company raising money through bank debt.

When all goes well, these investors get their money back (plus interest) through the income generated by the underlying assets over the years.

In order to increase investor interest and confidence in bond issuance, financial institutions “rate” bonds. Bond sellers typically seek an “A” rating or above; a much lower rating will result in some bonds being labeled “junk” bonds.global music business