Blackstone’s Hipgnosis has successfully completed a US$1.47 billion music copyright asset-backed securities transaction (i.e. bond issuance).

ABS trading, abbreviation Lyra 24-2,See investment giant black stone Increase US$1.47 billion Debt financing backed by royalties this 45,000-The Hipgnosis Songs fund portfolio it acquired in July.

black stone Acquired the assets of the Hipgnosis Songs Fund from HSF’s then-public shareholders in a deal valued at $1.584 billion.

According to an announcement on Monday (November 11) confirming the completion of the ABS transaction, proceeds from the issuance will be mainly used to “repay existing debt in full and support future acquisitions.”

As MBW reported last monthA recent report from Kroll Bond Ratings Citing an unnamed independent third-party valuation firm, which valued the HSF portfolio at US$2.36 billion Effective August 1, 2024.

just around here US$150 million Over the total amount HSF has purchased its portfolio over the years (US$2.206 billionaccording to financial documents).

Also around US$150 million Exceeds the estimated enterprise value of the portfolio $2.2 billion when black stone Got it this summer.

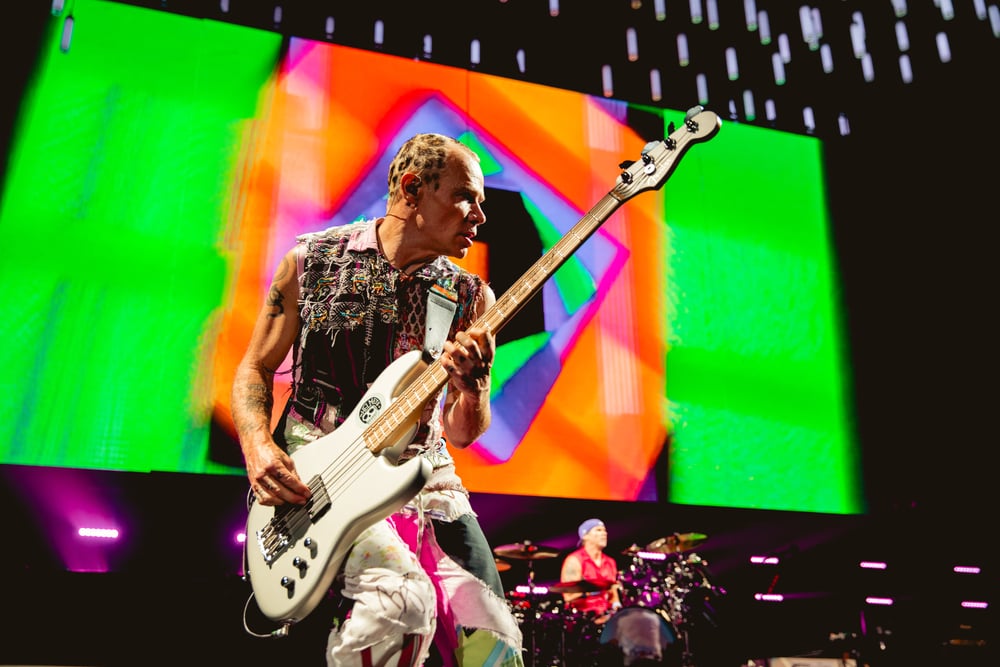

Portfolio (originally accumulated by former Hipgnosis bosses between 2018 and 2021) Merck) includes songs from Red Hot Chili Peppers, Fleetwood Mac, Journey, The Chainsmokers, Shakira, Bon Jovi, 50 Cent and Eurythmics.

Lyra music assets This is Hipgnosis Songs Assets’ second music royalty securitization. Back in 2022, previous pre-sale reports came from Kroll Hipgnosis confirmed to be launching music royalty-backed bond scheme – $221.65 million Securitization issuance.

KBRA confirmed at the time that the offering was called Music 2022-1which will be “collateralized with royalties from a music catalog of over 950 songs of premium content across five subcategories from top artists and songwriters, including Justin Timberlake, Nelly Furtado, and Leonard Cohen.” .

MUFG Securities was the structuring lead for Hipgnosis’ latest ABS deal, with Barclays, Goldman Sachs, Fifth Third Securities and SMBC Nikko acting as joint bookrunners. Blackstone Capital Markets serves as co-manager.

According to today’s announcement from Blackstone/Hipgnosis, “With 25 investors, the order represents one of the most diverse music rights ABS issuances to date.”

The notes are rated A- by Kroll Bond Ratings.

“This achievement not only enhances the quality and strength of our music catalog, but also enables us to unlock new growth and investment opportunities.”

Ben Katofsky and Dan Ponder, Hipgnosis

Hipgnosis CEO Ben Katovsky and Hipgnosis Chief Financial Officer Dan Pounder said: “We are pleased to announce the successful completion of our second asset-backed securitization, which is an important milestone for Hipgnosis.

“This achievement not only enhances the quality and strength of our music catalog, but also enables us to unlock new growth and investment opportunities.

“Music rights continue to be a rapidly growing investable asset class and we are excited to be a leader in this space as we are deeply committed to supporting songwriters and artists and enhancing the legacy of our songs through active song stewardship and value.

They added: “With the completion of this ABS refinancing, we remain committed to expanding our investor base and further institutionalizing the asset class by leveraging Hipgnosis’ proprietary technology and data analytics platform in underwriting, monitoring and reporting. .

“This landmark transaction not only highlights the strength of Hipgnosis’ superior product catalog, but also reflects our ability to provide innovative financial solutions to support its continued growth and success.”

Qasim Abbas, Blackstone Group

Qasim Abbas, Head of European Tactical Opportunities at Blackstone, added: “This landmark transaction not only highlights the strength of Hipgnosis’ superior product catalog, but also reflects our ability to deliver innovative financial solutions to support its continued growth and success.

“Our partnership underscores the long-term, sustainable value we see in music royalties, and we remain excited about the future.”

FTI Consulting is acting as the back-up manager for the transaction, and Citigroup is acting as trustee. Virtu Global Advisors, LLC provided valuation services, Latham & Watkins served as legal counsel to the issuer, and Paul Weiss, Rifkind, Wharton & Garrison served as legal counsel to the noteholders.

News of rights-backed securitization deals are becoming more frequent in the music industry.

Just two weeks ago, Concord closed an $850 million asset-backed securities transaction to “drive strategic growth and acquisitions.”

Concordant US$850 million ABS deal marks issuance of Series 3 notes as part of wider program $2.6 billion Bond release backed by music rights in Concord’s catalog.

As MBW first reported last month, a report from Kroll Bond Ratings revealed that proceeds from Concord’s latest ABS deal were used for acquisitions $217.3 million From the catalog of “a highly successful Latin music artist and songwriter.”

Elsewhere in the music industry, in March, Kobalt confirmed that $266.5 million Through its first-ever asset-backed securitization (ABS) transaction, the deal is backed by music royalties from more than 5,000 works by 66 authors.

Also in March, HarborView Equity Partners secured approx. US$500 million Debt financing through private securitization backed by its catalog of music royalties.

global music business