California, long the entertainment capital of the world, is taking bold legislative steps to raise its stance amid growing competition in other states and countries that offer more aggressive movie and television tax credits. 700 local members are helping to lead.

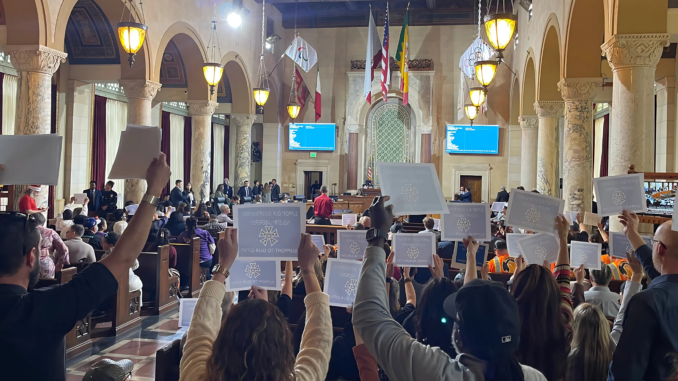

Guild members and staff have been actively lobbying Sacramento lawmakers to attend hearings and advocate for the rapid passage of two key bills, Bill 1138 (AB 1138) of 1138 and Senate Bill 630 (SB 630) (SB 630) (SB 630), which have become a central component of the state’s attracting and maintaining production strategies.

Written by Councilman Rick Chavez Zbur and Isaac Bryan and co-sponsored by Senator Ben Allen, AB 1138 attempts to modernize and expand California’s existing film and television tax credit program. It proposes a significant increase in annual funding (from $330 million to $750 million) and aims to expand eligibility to include a wider production. SB 630 complements this effort, strengthening the state’s commitment to revitalizing an industry that saw production drop by 40%, production declines since the second half of 2022 and a staggering 35 million hourly decline.

Supporting these legislative efforts is to keep California labor, a recreational union and a guild alliance representing 165,000 workers. The movement not only emphasizes the economic importance of the industry, but also its role in providing stable union work and promoting diversity through targeted labour development programs. Advocates believe that strong tax benefits are crucial to reverse the trend of production flights and economic losses.

AB 1138 and SB 630 have successfully cleared key committees, but their journey through the legislature continues. Supporters urged continued public participation to help push legislation across the finish line. Take action immediately.

Data from the past decade highlights the bet: every dollar invested in the state’s film and television work program generates $24.40 in economic activity and $1.07 in tax revenue. Between 2015 and 2020, California lost nearly $3.9 billion in economic output and 28,000 jobs due to production relocation to other states. Supporters warn that more than 120 global jurisdictions now offer incentives and the action now is.

Meanwhile, on the East Coast, New York continues to reaffirm its commitment to the industry. The Film Editors Association has long supported the state’s production and post-production tax credit program in partnership with the United Film and Television Lobbying Alliance and the New York Post-Coalition Union. This advocacy continues to maintain results: The approved fiscal year 2026 budget includes expanding and expanding incentive programs and maintaining provisions for New York’s entertainment-specific COBRA subsidy programs.

Although New York members do not need immediate action, the guild remains vigilant. Later this year, pending federal budget developments could impact state-level spending. Members are encouraged to remain engaged and ready to support future efforts to maintain support from these essential industries.

As both California and New York work hard to consolidate their role as a center for film and television production, the stakes are high—not just the future of entertainment, but the thousands of workers whose livelihoods depend on thriving, competitive industries.