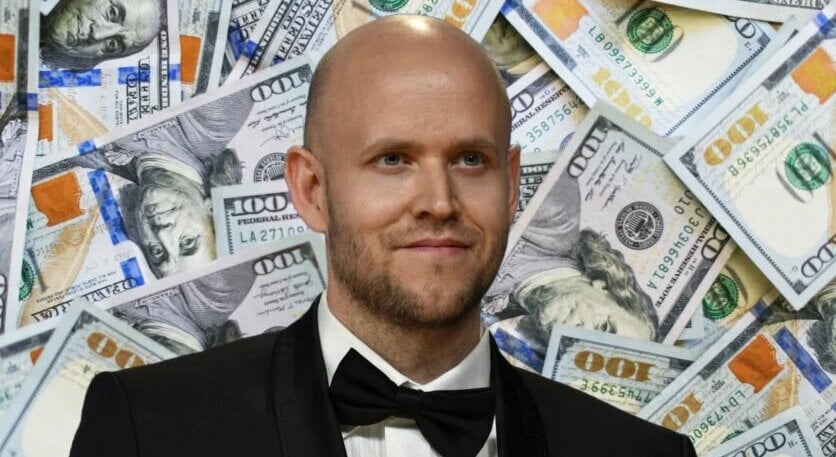

Spotify CEO and co-founder Daniel Ek has launched another major financial move heading into 2025.

Ek further sold $27.8 million The company’s stock price continued to trade sharply on Wednesday (January 8).

Since Ek first cashed out some of his Spotify stock July 2023he has been wandering around $568 million Total sales from spot inventory (including latest transactions), calculated based on MBW.

This week’s cash out is Ek continuing to exploit SpotifyShares soared, hitting an all-time high on December 4, 2024, surpassing $500.

When Spotify listed on the New York Stock Exchange in April 2018, its shares opened at $165.90.

According to a new SEC filing spotted by MBW, Ek’s latest deal involves the sale of 60,000 The market price of the stock is $463.93.

The latest deal arrived two weeks after Ek cashed out US$27.72 million stocks on December 23, shortly before the holidays.

These recent deals cap off a strong year of stock sales for the Spotify CEO, who has a calendar year of 2024 deal totals $376 millionaccording to MBW’s calculate.

Ek’s latest stock sale marks the eleventh time since July 2023 that he has cashed out some of his Spotify stock:

- For sale in July 2023 675,000 The shares are US$100 million in earnings;

- In October 2023, he sold 400,000 The shares are $64.2 million in earnings;

- For sale in February 2024 250,000 The shares are $57.5 million in earnings;

- April 2024, Ek for sale 400,000 The shares are $118.8 million in earnings;

- For sale in November 2024 75,000 The shares are $35.8 million in earnings;

- In November 2024, Ek sold another 75,000 The shares are $34.8 million in earnings;

- For sale in November 2024 75,000 Sharing again, this time for $36.1 million in earnings;

- In December 2024, Ek sold again 75,000 stock Earnings $37 million;

- Also in December 2024, Ek sold 60,000 The shares are $28.3 million in earnings;

- In December, Ek again 60,000 shares sold for $27.7 million in earnings.

combine this week $27.8 million Cash in, everything comes $568 million.

However, since July 2017, Ek has chosen to forgo traditional salary and instead tie his financial interests directly to the company’s market performance.

MBW noted in 2018 that Ek ditched traditional salary in favor of a performance-based bonus plan tied to specific growth metrics.

MBW I have also been tracking the stock sales of Spotify co-founders, Martin Lorenson. Lorenzo’s cash stock sales, typically through his Rosselló company, amounted to $556.8 It will reach 1 million by 2024.

However, Lorentzon did not divest any shares in December.

As of December 31, 2023, Ek and Lorentzon held 15.6% and 10.9% Hold shares of the company respectively, with voting rights of 30.5% and 42.7%According to Spotify’s 2023 annual report respectively. Lorentzon also served on Spotify’s board of directors.

The deals signal executives’ confidence in the future of Spotify, which leads market share in most regions around the world, and industry-wide optimism about the streaming service’s potential to make sustainable profits. The company continues to expand its offerings beyond music, investing heavily in podcasts, audiobooks and even videos while exploring new revenue streams.

Looking ahead, Spotify plans to announce fourth-quarter 2024 financial results on February 4. 4.1 billion euros ($4.2 billion), operating profit was 481 million euros for season four. If these goals are achieved, Spotify’s annual revenue will be approximately 15.5 billion euros Operating profit is 1.37 billion euros 2024.

As of Wednesday (January 8), Spotify’s share price was $479.73maintaining strong market capitalization US$96.33 billion.

global music business