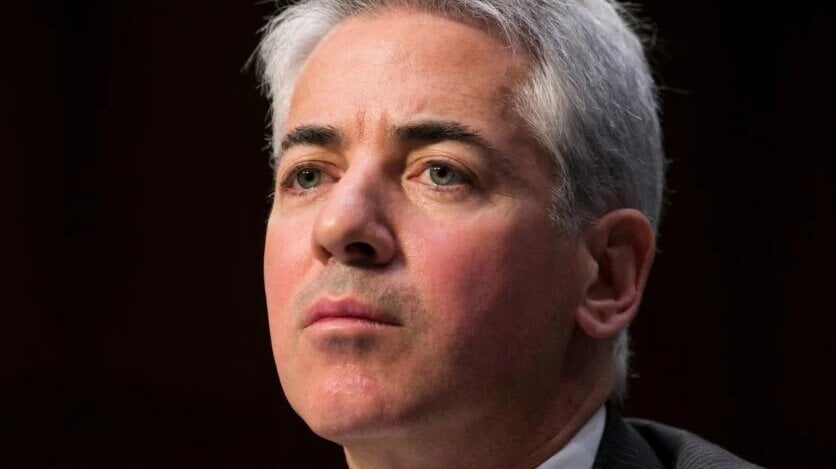

Universal Music Group (UMG) announced on Wednesday (January 15) that Pershing Square Holdings, led by billionaire investor Bill Ackman, has asked the music company to list on U.S. securities exchanges conducted a secondary listing.

Under a previously disclosed agreement, Universal Music Group will assist with underwriting pershing square Partial shares will be sold by September 15, 2025.

The deal requires Pershing to sell at least US$500 million The value of its shares in UMG as part of the flotation process.

“Pershing Square has exercised its rights under the previously disclosed registration rights agreement between UMG and Pershing to require UMG to conduct an offering and secondary listing in the United States,” UMG said.

“Pershing has waived the 120-day filing requirement and, subject to its contractual obligations, UMG will use commercially reasonable efforts to initiate an underwritten offering to sell certain shares owned by Pershing before September 15, 2025, subject to regulatory Institutional Approval and Approval.

Ackman confirmed the move on social media platform US$500 million UMG shares tied to a US listing (currently $3.3 billion invested in the company), we will complete the sale in order to go public.

“We are exercising our right to list UMG in the United States because we believe it will significantly increase demand for (and therefore valuation of) UMG shares from investors who are authorized to invest only in securities listed on U.S. exchanges and may attract More investor and analyst coverage of the company. We also believe that a U.S. listing will significantly improve the trading liquidity of the stock.

“We gave up 120 days The filing request and extension of the date to mid-September will allow UMG appropriate time to complete the listing and offering in a manner that is most beneficial to the company and its shareholders.

“Pershing Square has exercised its rights under the previously disclosed registration rights agreement between UMG and Pershing to require UMG to conduct an offering and secondary listing in the United States.”

universal music group

The move comes after Pershing Square Capital Management allocated 47 million shares, representatives 2.6% UMG revealed the news to the fund’s co-investors earlier this month.

After the assignment, Pershing Square retained 140 million shares, equivalent to 7.6% Universal shares.

It now looks like Pershing Square will be up for sale further, based on Ackman’s note today worth US$500 million UMG shares are listed on U.S. exchanges.

Universal Music Group is pushing for a U.S. listing after tensions emerged in the business climate in Amsterdam.

In November 2024, Ackermann expressed his intention to move Pershing Square and UMG out of Amsterdam following incidents between local football club Ajax and Maccabi Tel Aviv. Pershing Square was subsequently delisted from Euronext Amsterdam in December 2023.

At the time, Ackmann said the violence in Amsterdam was a “turning point” in the decision to delist from the city’s stock exchange.

“Concentrating listings on one exchange, the London Stock Exchange, and leaving a jurisdiction that fails to protect tourists and minority ethnic populations combines good business principles with ethical principles. We can also save money and Improve shareholder liquidity,” Ackman wrote.

However, UMG said Pershing Square does not have the authority to require the music company to become a U.S.-registered company or delist from Euronext Amsterdam.

The development also marks a new chapter in the company’s relationship with Pershing Square. Ackman’s investment firm has repeatedly adjusted its stake in the music company, having previously reduced its stake to 7.48% from 10% UMG rejects previous request to delist from Amsterdam Reuters Famous.

Recently, the music company said the final decision on any actions beyond its contractual obligations will be made by Universal Music Group’s board of directors, which will analyze what will deliver the greatest value for all shareholders.

UMG, home to artists from around the world including Taylor Swiftremains one of the largest music companies in the world. An upcoming U.S. listing could expand its investor base.

French national oil company Exane Analyst William Packer has followed UMG and its stock performance closely for years.

A U.S. listing is expected in 2025, he said in a research note this morning, suggesting it could bring benefits such as improved liquidity and potential index inclusion.

Parker expects Universal Music Group to maintain its Amsterdam domicile while pursuing a dual-listing strategy.

“We anticipate listing in the U.S. in 2025, bringing with it liquidity, index inclusion and other benefits,” he wrote. “While uncertainty remains at this stage, we expect to maintain our dual listing and Amsterdam domicile. We note , as a foreign private issuer, we believe that UMG will not be subject to GAAP accounting in certain circumstances.

Packer noted that UMG stock faces challenges in 2024, underperforming the media industry, as its second-quarter warning prompts a reassessment of subscription streaming’s long-term growth potential.

“While uncertainty remains at this stage, we expect the dual listing and Amsterdam registration to be maintained.”

French national oil company Exane

This was due to factors including slower sales growth, DSP pricing issues, and poor ad-supported streaming performance Yuan, Tik Tokand short films, he said.

However, Packer added: “With expectations recalibrating and the company committed to executing on its Streaming 2.0 vision, we believe the outlook for 2025 will improve significantly and identify UMG as a key choice for media in 2025.”

global music business